This funding comes with no fees for added settlements and no early leave costs. It is also one of the most common finance alternative used amongst financial institutions so you have more opportunities to contrast and decide. Hence, where a traditional finance fees rate of interest as well as enforces compounding interests on late repayments, Islamic finances do not.

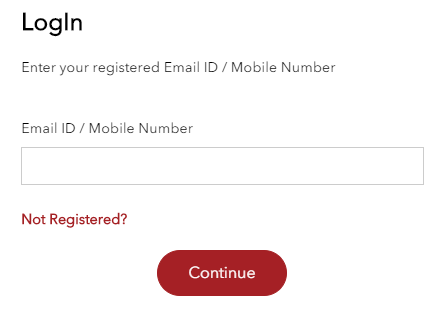

MyLoanCare does not charge any type of costs for processing your application. As soon as your application and documents are confirmed by the lender, the lending quantity will be credited to your account. Complete your details on the online finance application form.

- Some of the benefits as well as attributes of Flexi personal funding are discussed listed below.

- Flexi Funding significance is an individual lending that includes a pre-approved lending limitation where any quantity can be taken out as and when the need develops.

- Crossbreed Flexi Lending-- A crossbreed Flexi loan, on the other hand, calls for the debtor to pay the rate of interest only on the amount that is made use of.

- There are several ways to counter a challenging economic situation.

- You can use the financing for any type of purpose, and the passion is charged just on the amount you desire to use.

After successful document confirmation, the accepted quantity will certainly be attributed to your lending account. You can take out funds according to your demands as well as transfer it to your interest-bearing account within 2 hours. It supplies instantaneous disbursal, making funds easily available when the need develops.

Interest is charged at the end of the day as well as you can use theFlexi Day-Wise Rate of interest Calculatorto use the car loan ideally. A personal loan is a perfect remedy to a range of financial issues. Whether you would such as funds to restore your home or to see your dream holiday location, you'll obtain a moment's customer finance and placed an end to all or any of your fears. The funding doesn't call for any type of safety and security and may be authorized swiftly. A 'hybrid Flexi customer car loan' might be a variant to the typical kind of personal funding.

Flexi Vs Non

3) Must fall under age limitations as prescribed by the loan provider. You'll require to show you've been in business for at the very least 18 months, the last two Take a look at the site here months' service bank statements and also in 2015's Notification of Evaluation. Inspect the details on your credit scores record are right prior to applying.

Because it'll allow you make unlimited withdrawals from your current account whenever you need it. In addition to that, you can handle your financial resources easily using ATM, electronic banking, DuitNow, JomPay and a lot more. This ways you can withdraw the cash when you require the money quickly or even for your high return financial investment. In addition, BOCM is running a great promotion rate of 3.80% p.a.

Fundamental Term Funding Non

This cut the OPR rate to 1.75%, the lowest price on record. Might need to make a request to the bank to pay the added amounts. You may be given a cheque book and/or an ATM card to withdraw the cash whenever you need it. Stress totally free financings as you do not need to supply any kind of safety. There are several ways to respond to a challenging monetary scenario. You can utilize your financial savings, but that impacts your riches as well as leaves you unprepared for prospective troubles in the future.

Alternatively, lots of people retrieve their investments to meet monetary problems. Doing so, however, guarantees you do not meet your financial investment objectives. We'll ensure you're the very first to know the minute rates change.

How To Choose The Optimum Period For Personal Finances

In typical individual financings, the accepted funding amount is paid out in a single payment. Meanwhile, in a Flexi finance, you can not exceed a line of credit. It guarantees that you are borrowing just the amount you need, giving you control over your finance. To determine their payment with monthly installments, flexi individual lending consumers can determine their EMIs utilizing the Flexi personal finance EMI calculator. For the calculation, one ought to enter the lending quantity he/she desires to obtain and the feasible rate of interest.